In today’s fast-paced and dynamic financial markets, investors are constantly seeking innovative tools to diversify their portfolios and maximize returns. One such instrument that has gained significant popularity in recent years is the Contract for Difference (CFD). CFD trading have revolutionized the way traders and investors approach the markets, offering a range of benefits and opportunities.

What are CFDs?

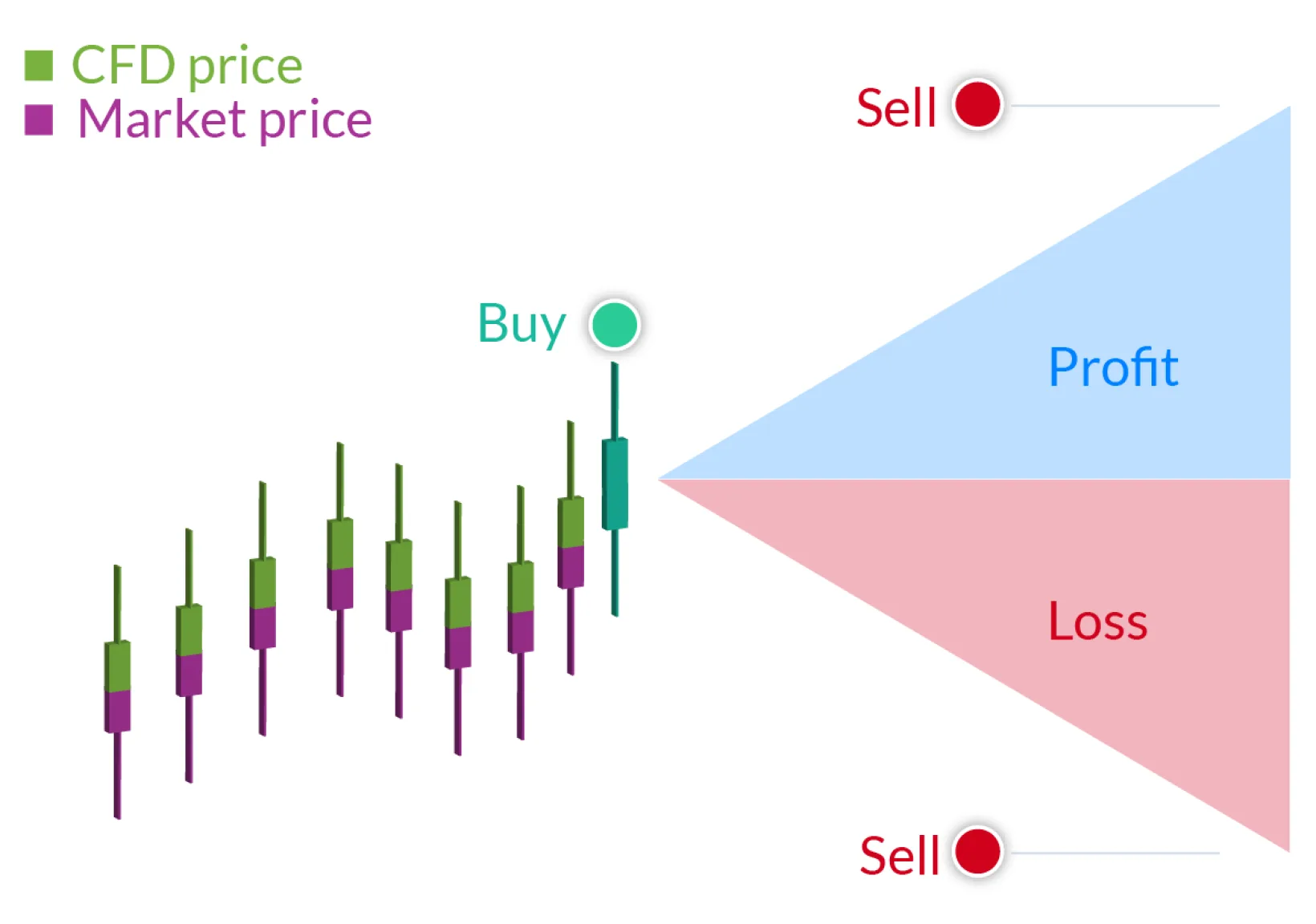

A Contract for Difference is an agreement between two parties to exchange the difference in the value of a financial instrument from the time the contract is opened until it is closed. CFDs allow traders to speculate on the price movements of various assets, including stocks, indices, commodities, and currencies, without actually owning the underlying asset.

Flexibility and Accessibility

One of the key advantages of CFDs is their flexibility. Traders can access a wide range of markets from a single platform, enabling them to diversify their portfolios with ease. CFDs also offer flexible leverage options, allowing traders to control larger positions with a smaller initial investment. This leverage can amplify potential profits, but it is essential to understand the associated risks and manage them effectively.

Cost-Effective Trading

CFDs are known for their cost-effectiveness compared to traditional trading methods. With CFDs, there are no direct fees for opening or closing positions. Instead, the costs are typically built into the spread, which is the difference between the buy and sell prices. Additionally, CFDs do not involve the physical delivery of assets, eliminating the need for storage or transportation costs.

Potential for Profitability

CFDs provide the opportunity to profit from both rising and falling markets. Traders can take long positions when they expect prices to increase or short positions when they anticipate a decline. This versatility allows traders to adapt to various market conditions and capitalize on price movements in either direction.

Risk Management

While CFDs offer numerous benefits, it is crucial to understand and manage the associated risks. Due to the leveraged nature of CFDs, potential losses can be magnified just as much as potential gains. Traders should employ robust risk management strategies, such as setting stop-loss orders and maintaining appropriate position sizing, to protect their capital.

Conclusion

CFDs have become an integral part of modern investment portfolios, offering traders and investors a flexible, cost-effective, and potentially profitable way to participate in the financial markets. By understanding the characteristics and risks associated with CFDs, individuals can make informed decisions and incorporate these instruments into their trading strategies effectively. As with any investment, thorough research, education, and risk management are essential for success in the dynamic world of CFD trading.